Claim 1: Fauji Foods has reported a 73% loss of 2.16 billion rupees.

Claim 2: The sales of Nurpur butter have dropped by 85%.

Fact 1: The 73% loss of 2.16 billion reported by Fauji Foods is from 2022. While stock prices for Fauji companies did drop on 6 December 2024, they have since risen.

Fact 2: There is no evidence that sales of Nurpur butter dropped by 85%.

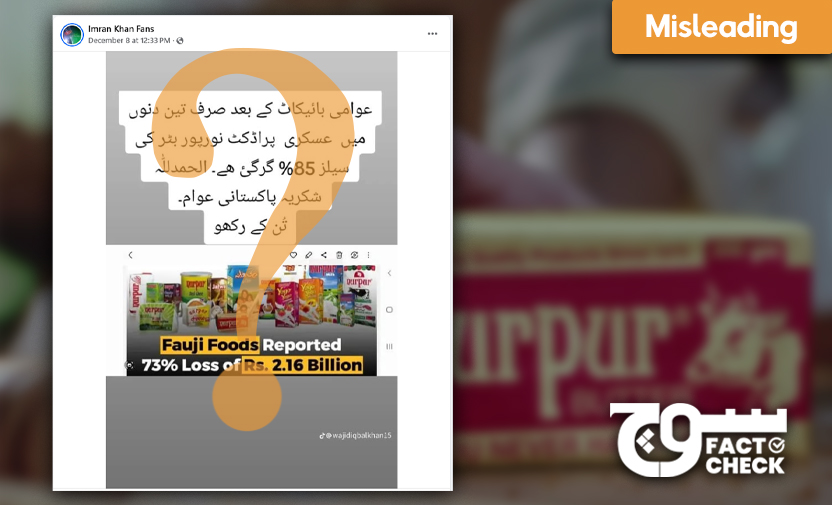

On 8 December 2024, a post on Facebook included a picture of Fauji Foods’ products with the following caption in English:

“Fauji Foods Reported 73% Loss of Rs. 2.16 Billion”

The picture also contained a caption in Urdu at the top, which read as follows:

“عوامی بائیکاٹ کے بعد صرف تین دنوں میں عسکری پراڈکٹ نورپور بٹر کی سیلز 85% گر گئ ھے۔ الحمدلله شکریہ پاکستانی عوام”

According to Google Translate, this reads as follows in English:

“After the public boycott, the sales of military product Nurpur Butter fell by 85% in just three days. Alhamdulillah, thank you people of Pakistan.”

These posts come in the wake of the recent PTI protests in Islamabad and the subsequent calls to boycott companies owned by the Pakistani establishment. AI-generated videos of products belonging to such companies have also gone viral on social media.

The protests in Islamabad in November 2024 were the result of former Prime Minister Imran Khan issuing a “final call” to his supporters to gather in the capital. The reasons for the protest, as described in the final call, were to restore the 26th Amendment to its original state, reclaim the stolen mandate, and release all political prisoners who are being held without trial.

Prior to protesters entering Islamabad, the city was put under lockdown and Section 144 was reimposed on the capital on 18 November. Tensions heightened on 26 November when protesters clashed with security forces, and a midnight raid forced them to retreat. The protest was consequently called off the following day on 27 November.

As of now, terrorism cases have been filed against prominent PTI members, including Khan himself, and arrest warrants have been issued for Khyber Pakhtunkhwa’s Chief Minister Ali Amin Gandapur and Imran Khan’s wife, Bushra Bibi. Gandapur has also approached the Islamabad High Court (IHC) to challenge the terrorism charges against him.

Fact or Fiction?

Did Fauji Foods experience a loss of 73% equalling 2.16 billion in 2024?

Conducting a reverse-image search of the image in the claim, Soch Fact Check came across a post by Startup Pakistan on LinkedIn from one year ago that showed the same picture of Fauji Foods products. The picture contains a caption identical to the English caption in the claim, but mentions “in 2022” at the end. The entire caption, therefore, read as follows:

“Fauji Foods Reported 73% Loss of Rs. 2.16 Billion in 2022”.

While we did attempt to find the original post on the Startup Pakistan website, there was no record of it. Identical posts, however, were on Startup Pakistan’s Facebook and Instagram pages, both dated 27 January 2023.

Looking into Fauji Foods’ 2022 annual report, we found (on page 29) that the corporation faced Rs 2.168 billion in loss after tax. A screenshot from the report is shown below:

Though Fauji Foods has not yet released its 2024 annual report, we did find a report on the company’s performance for the six-month-period (ending on 30 June 2024). According to page 3 of the report, in the first half of 2024, Fauji Foods posted Rs 337 million as profit after tax (PAT) and incurred a loss of Rs 147 million.

Hence, the Facebook post shared a misleading picture that showed the loss after tax incurred by Fauji Foods in 2022, not in 2024 as a result of a boycott of its products.

However, Soch Fact Check found that the stock prices of some Fauji companies did decline recently, on 26 November and then again on 6 December. We came across the following two photos on X that claimed stock prices of Fauji companies experienced a “tumble” as a result of a nationwide boycott:

The one on the left is dated 11 December 2024 and was found here. Its caption reads as follows:

“The boycott campaign is working. Fauji Foods is sinking, and its stock prices are plummeting. Keep the boycott going and see its stocks drop to single digits soon.”

The one on the right is dated 9 December 2024 and was found here. Its caption reads as follows:

خبردار جو کسی نے بائیکاٹ ختم کیا تو!!! اس کا مطلب ہو گا کہ آپ اپنے بھائی کا خون پی رہے ہیں۔”

فوجی_مصنوعات_کا_بائیکاٹ#

“بائیکاٹ_فوجی_مصنوعات#

According to Google Translate, this reads as follows in English:

“Beware if anyone ends the boycott!!! That would mean you are drinking your brother’s blood.

#Boycott of military products

#Boycott_Military_Products”

Both these claims appear to have originated from Instagram posts by the Pakistan Tribune and Pakistan Republic, respectively, dated 7 December 2024.

Though no data about stock prices was shared on the posts on X, the Instagram posts’ identical captions list the decrease in stock prices of the following companies:

“• Fauji Cement Company Ltd (FCCL): Closed at 38.07, dropping 3.15% (-1.24).

- Fauji Fertilizer Bin Qasim Ltd (FFBL): Closed at 81.43, falling 0.53% (-0.43).

- Fauji Fertilizer Company Ltd (FFC): Closed at 347.08, down 0.58% (-2.04).

- Fauji Foods Ltd (FFL): Closed at 14.03, decreasing 2.5% (-0.36).”

Consulting the Pakistan Stock Exchange data portal, we found that these figures are from 6 December 2024 and the losses stated are, in fact, accurate. Looking at the infographics, it is also significant that the stock prices of the aforementioned companies plummeted on 26 November 2024—during the height of clashes between protesters and security forces in Islamabad.

Graphs showing the stock prices for these companies for the period of 12 November to 12 December 2024 are shown below. The sharp dip in prices on 26 November is shown in red, while the decrease in prices on 6 December is shown in green:

However, as seen above, this decline was momentary. The stock prices for all the companies show a general upward trend throughout the month. Immediately after 6 December, all of the companies—barring Fauji Fertilizer Bin Qasim Limited—showed an increase in their respective stock prices. Moreover, all the companies, as of 4:29 pm on 13 December 2024, stand at a higher stock price than their prices on 6 December.

Considering that the claims on X did not mention that the stock prices dropped only temporarily, these posts and their captions are also misleading.

Did sales of Nurpur butter drop by 85%?

The Facebook post also stated that sales of Nurpur butter have dropped by 85%. However, neither the 2022 annual report nor the 2024 half-year report mention the number of sales of a specific brand (like Nurpur) under Fauji Foods. Page 37 of the 2022 annual report does mention the net sales for the year, which amounted to Rs 12,350,702,000 (over Rs 12 billion), but sales from specific brands are not quoted.

Hence, it is unclear where the figure of 85% is quoted from. There are no official or publicly available sources which disclosed such information in the first place.

Virality

The post on Facebook has amassed 40 K reactions, 3 K comments, and 8.5 K shares.

On Facebook, it was shared here, here, and here.

On X, it was shared here, here, here, and here.

On Facebook, the claims that stock prices of Fauji companies had tumbled were shared here, here, and here.

On X, they were shared here, here, here, and here.

On Instagram, they were shared here, here, and here.

Conclusion 1: Fauji Foods did not experience a 73% loss of 2.16 billion this year as a result of the boycott of their products following the protests in Islamabad. While the stock prices of some Fauji companies declined on 26 November and 6 December 2024, they have since risen.

Conclusion 2: There is no evidence to show that the sales of Nurpur butter dropped by 85%.

—

Background image in cover photo: YouTube

To appeal against our fact-check, please send an email to appeals@sochfactcheck.com